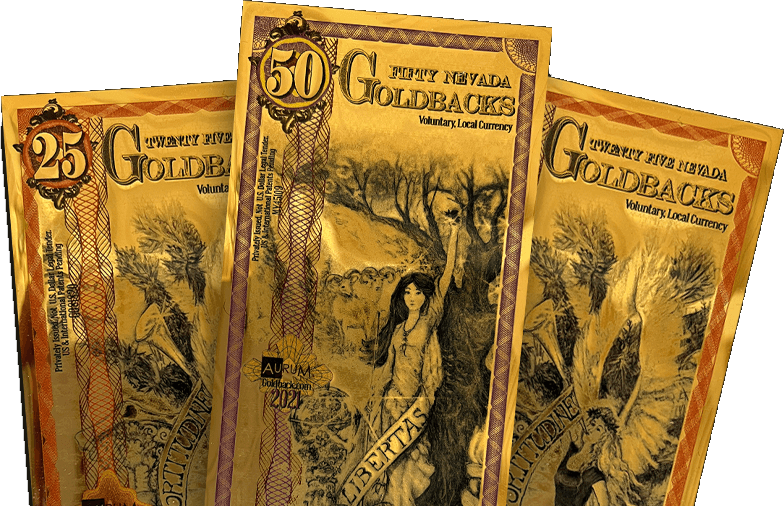

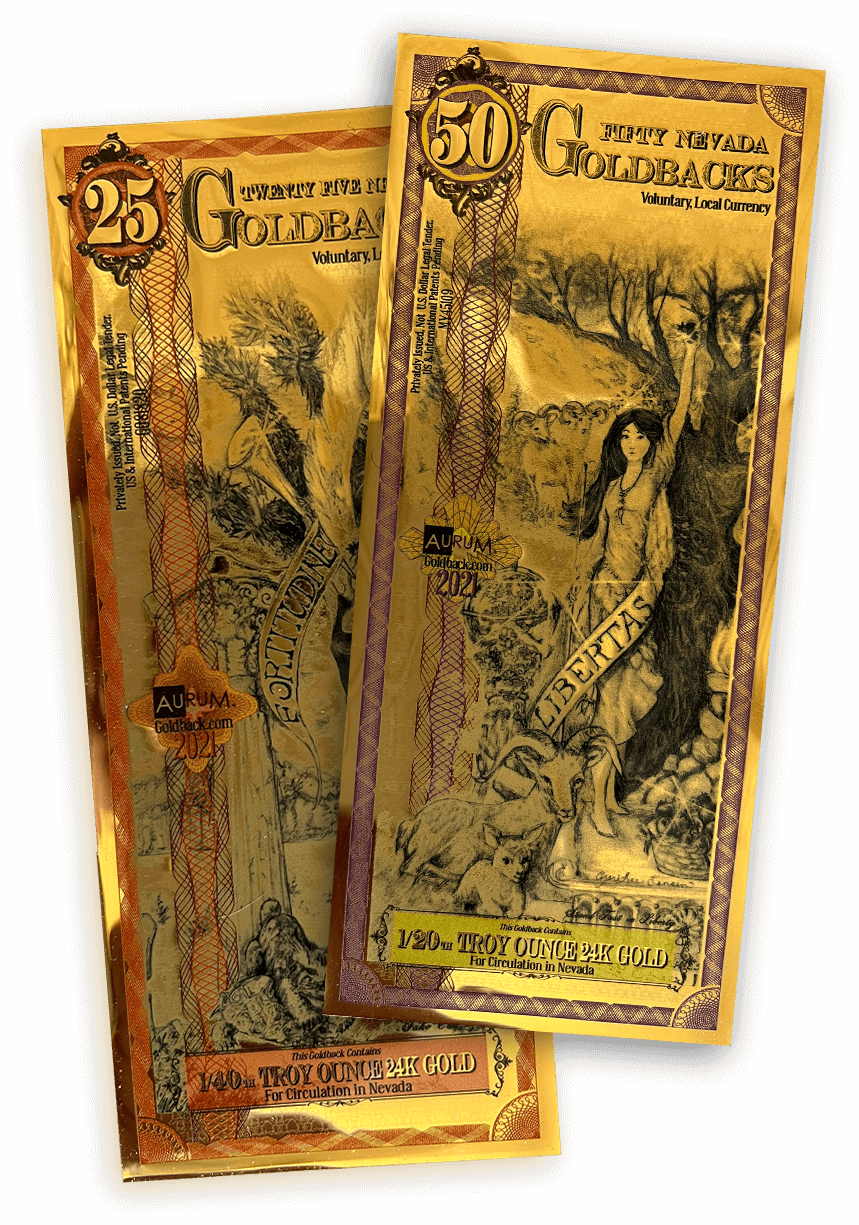

Goldbacks are a Voluntary Barter Asset Made of Gold

Goldbacks are beautiful and durable and are both easily spendable and a long term store of value. Unlike paper fiat currencies, Goldbacks are made of 24K gold, which preserves their value against the ravages of inflation.

Unlike traditional coins, Goldbacks are bendable and slide easily into your wallet, and contain small, precise weights of 24 karat gold laminated between thin protective sheets of plastic. Goldbacks have all the advantages of gold, because they are made of gold: Goldbacks hold their value while paper money declines in purchasing power, usually gradually but sometimes, as during an economic crisis, rather suddenly. Using Goldbacks is also a completely private and is independent of the existence of any functioning electronic systems or digital networks. With Goldbacks in your wallet, you can buy things even if the power goes out, or the internet is down, or your cellphone is out of range or its battery is dead, or if your bank or even the entire banking system is closed down.

“

The Goldback solves a 2,600 year old problem in that gold can be spent in small, interchangeable increments.”

— DR. MARK VOELKER, UNITED PRECIOUS METALS ASSOCIATION BOARD MEMBER

Money, Debt, and Financial Crises

You probably have heard quite a lot about the perilous state our economy is in, and perhaps even remember the 2007-2008 world financial crisis, which has been dubbed the “Great Recession”. That crisis is typical of the type of instability inherent in our fiat banking system, and is caused by buildup of too much debt throughout the economy. In a fiat banking system, the money itself is “backed by” (made up of) debt. So when you pay someone by giving them dollars, you are giving them debt. Your personal debt to that person is eliminated by giving that person someone else’s debt. That someone else, is the taxpayers of America. Every fiat dollar in existence is an IOU that bears interest, which the taxpayers of America, the “I” in IOU, have to eventually pay back… or roll over with even more government borrowing. That rolling over delays the day when the government’s debt must be paid back, or even just paid down a bit. It is as if the entire country, is living off a giant credit card, whose monthly payments must come from the taxpayers. Who gets to put charges on that credit card, is determined by politics. If you have pull in Washington, you get to spend dollars the government has borrowed on the backs of the taxpayers.

Systemic Bankruptcy

The spiral in increasing debt throughout society described above, ultimately leads to systemic bankruptcy. Most people understand bankruptcy on a personal level: If you owe more than you can pay back, you are bankrupt. If you cannot even service your debt (keep current on your total monthly payments), you default (quit paying on some or all of your loans), and your creditor (the person to whom you owe) can do one of three things:

1) Write off his loss and walk away, 2) Work with you to “restructure” your loan, perhaps with lower monthly payments, so he has a chance of not losing all of his loan to you, or 3) Take you to court to try to get paid back as least part of what you owe him.

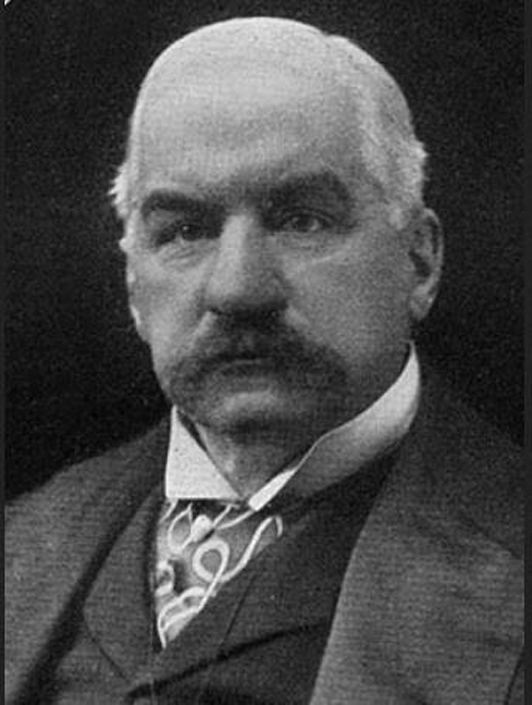

“Money is gold and nothing else. … Everything else is credit.”

– said J. P. Morgan (1837-1913), testifying to Congress in 1912 on the financial crisis that occurred in 1907.

J.P. Morgan was the leading financier of the early 20th century. In the quote above, he was explaining in Congressional testimony, the nature of money and banking. Included in his “everything else” is what we now call “cash”, that is, paper money. He was saying that paper money is not money, it is IOUs for money, which is gold.

Issuing paper banknotes is not “printing money”, it is extending credit. Money is gold, which cannot be printed. When the Federal Reserve issues its “notes” (those pieces of green paper in your wallet, or their digital equivalent) it is lending (extending credit) to the US Treasury. The taxpayers are obliged to make the interest and principal payments on the resulting debt. Every time the Federal Reserve “creates more liquidity” to bail out politically influential people or groups during a “liquidity crisis (financial crisis)”, the burden on us, the taxpayers, goes up. At some point, the increasing debt load that exists throughout society can no longer be serviced, and the banking system, and with it the entire economy, suffers a serious crisis, seizes up, and stops working. The result is widespread chaos and economic collapse.